When it comes to personal finance, public education low key sucks. In my high school, every senior took an economics class every other day for half a year. I remember putting together a fake budget and following the stock market for a week, but that was about it.

It isn’t completely the educational system’s fault. Teenagers don’t have the experience necessary to fully grasp finances. At eighteen, I only had two years of part time work under my belt and large amounts of money felt theoretical. Retirement funds and health insurance didn’t seem all that important. And fiddling with the stock market sounded like a gamble, not a smart financial decision.

Six years and one YouTube subscription to Caleb Hammer later, personal finance makes a lot more sense. Here are some basic guidelines to get started on your journey.

Create and stick to a budget.

From budgeting apps to spreadsheets, there are several ways to track your expenses. A lot of apps can track your card activity automatically and tell you where your money is going. When you set goals for your spending categories, it’ll tell you how far under or over budget you are.

I had fun making my own spreadsheet. (Feel free to use it!) At the end of each month, I adjust my budget for the upcoming month in the gray areas. Whenever I make a purchase, I immediately throw the expense into the white area of the spreadsheet. I don’t touch the yellow or dark gray, because the sheet calculates those numbers for me.

At the bottom, it’ll calculate my income minus my expenses. From there, I can decide how much of my earnings to put in savings, retirement, or towards my student loans.

As you build your budget, look through your bank and credit card statements to get a general idea of how much you make and spend in a month. You should make more money than you spend.

If you spend more money than you make in a month, something needs to change and soon. You’re in deep shit otherwise.

As an adult, you should have financial goals— like building an emergency fund, paying off debt, or saving for retirement. To meet those goals, consider cutting expenses. Try canceling subscriptions, eating out less, and minimizing unnecessary shopping. (My parents used to tell me “If you can’t afford to buy it twice, you can’t afford to buy it once.”)

Ideally, 50% or less of your money will go towards your needs, 30% towards your wants, and 20% towards savings and/or debt repayments. The chart at the bottom of my spreadsheet shows how much you spent in each category.

Following through with a budget is the hard part. You’ll probably have to make adjustments, especially in the first month or two of budgeting. Make sure you prioritize your needs over your wants.

Needs:

- A roof over your head

- Groceries at home

- Gas in your car

- Toiletries

- Minimum monthly credit card payments (to avoid late fees and accrued interest)

- Healthcare

- Therapy

- Gym membership

Wants:

- Eating out

- Unnecessary shopping

- Vacations

- Gift giving

- Subscriptions

Budgeting requires discipline and self restraint. Building these skills takes time. If you struggle making unnecessary purchases, try waiting a few days to buy the thing you want. The craving might pass.

Keep in mind that small expenses add up. A five dollar coffee every workday is one hundred dollars a month. If that fits in your 50/30/20, that’s great! If not, try making coffee at home most days and treating yourself to Starbucks every once in awhile.

You can also adjust your budget as you go— if you overspend in one category, see if there’s a different expense you can cut. Your budget is a living document, not a be-all-end-all. It’s better to fail and keep trying instead of falling off the bandwagon completely.

Are you a credit card person?

Having debt is the American way. That’s a bad thing.

Credit card companies make money by letting you borrow theirs and then charging interest when you don’t pay them back by the following pay period. If you pay your card off every month, they won’t charge you interest.

My sister didn’t know that. She thought you always paid interest on your purchases no matter what, because she always had a balance on her card.

A lot of credit cards may starting you with a 0% APR (annual percentage rate) for twelve months, which means they won’t charge you interest until that period ends. That’s great! But if you don’t pay the balance off before the period ends, you’ll start being charged interest.

If you only make the minimum monthly payment each month, it’ll take longer to pay off your balance and you’ll pay more in interest. Credit cards usually have high interest rates averaging around 20-30%. That’s insane compared to the interest rates you’ll find on most student loans, mortgages, and car loans.

Take a look at your credit card statement: it’ll tell you how much interest has been charged this month and how much has been charged this year. Caleb would say “[that amount of money] has been stolen from you so far this year!” It’s money you wouldn’t have had to pay the credit card company if you paid the card off each month.

Credit cards have their perks. You can receive cash back bonuses, build your credit score, and they’re often safer than using your debt card for online purchases.

Those perks aren’t worth paying hundreds of dollars a year in interest.

Caleb sorts people into two categories: Credit card people and not credit card people. A credit card person treats their credit card like it’s basically a debt card. They pay their credit card off each month; they don’t have to worry about interest, because they don’t let it accrue. That way, they receive the benefits without the drawbacks. (By the way, you should avoid credit cards that charge a fee for just being opened. They’re predatory and stupid.)

If you aren’t a credit card person, you don’t pay your card off every month. Interest accrues. If you’re really bad at using credit cards, you max it out. You get charged late fees for not paying the card’s minimum balance. The company sucks more and more interest from you.

If you’re trying to pay off a card, you shouldn’t make purchases on it. Credit card companies make sure you pay off the interest first. Adding more to the balance of your card— especially if you’re purchasing more than you’re paying off— is counter intuitive.

If you aren’t a credit card person, that’s okay. Most people aren’t. Cut up the card, close the account, and focus on paying the balance off. You don’t need a credit card to function in society.

There are credit cards, usually marketed towards students, that automatically take the money out of your checking account. Since it operates like a credit card, it builds your credit while having the same consequences of a debt card. You can also use PayPal— only hook it up to your debt card— for an extra layer of protection while shopping online. And cash back bonuses don’t matter if you’re paying an ass ton of interest!

So answer this: Are you a credit card person?

If you aren’t, what steps will you take to end the cycle?

Have an emergency fund.

If shit hits the financial fan— your car dies, your dog breaks her leg, you lose your job— what do you do?

Ideally, you’d use your emergency fund.

An emergency fund helps you cover the cost of emergencies that may arise. Because shit will happen. That’s life.

These funds should be easily accessible. Put them in a savings account and let the bank pay you interest for holding onto your money. Don’t touch this money for any reason. Not for vacations. Not for Christmas gifts. Not for anything outside of a legit emergency.

A credit card is not an emergency fund. You don’t need to deal with being charged interest on top of dealing with an emergency.

Ideally, your emergency fund should cover six months of your living expenses. If you don’t have that laying around, a thousand dollars is a good place to start while you save up the rest. Just keep in mind that a thousand dollars won’t cover most emergencies.

When my Mom’s dog broke her leg, it cost about $10,000 to surgically fix Nala’s injury. They wouldn’t schedule the surgery without a down payment and Mom had to put that money on a credit card, because she didn’t have enough in her savings.

Nala healed just fine, but the situation was ten times more stressful, because we had to worry about the financial aspect of the surgery. And Mom was not about to take the cheap option and have her baby-dog’s leg cut off when the surgical vet had a good chance of saving it.

If you’re a credit card person, you can probably get away with throwing the expense onto a credit card while you wait for the funds to transfer from your savings account. But pay it off immediately!

If you aren’t a credit card person, make sure your savings account is hooked up to the same bank as your debt card. That way, you can instantly transfer funds between the accounts. The point of this fund is to be accessible.

Have the right savings account.

A savings account at a regular brick-and-mortar bank will earn you less than 1% APR, which means you’ll earn pennies each month for having thousands saved.

Instead, put your funds in a high yield savings account. Most high yield savings accounts will be through online banks, since they save money on expenses brick-and-mortar banks have to account for. With 4%-5% APR, you’ll earn dollars instead of pennies on the same amount of money. It may not seem like much, but it adds up.

Invest in your future.

A high yield savings account is one way to invest, but there are also 401(k) plans, IRAs, individual stocks, and much more.

No matter how you invest, compound growth is your best friend. Caleb explains it best in this clip here. (Watch it for two minutes. Just two minutes.) Basically, if you invest a dollar and it gains 10% a year, you’ll now have $1.10. If it gains 10% the next year, you’ll gain eleven cents instead of ten for a total of $1.21. Year after year, you gain more and more money.

It sounds like chump change when you start with a dollar, but what if you start with a hundred dollars? Or a thousand?

The earlier you invest, the more time your money has to grow via compound growth. It’s worth starting early even if you can only contribute a few dollars a month. The amount of money you’ll be able to make will drastically decrease the longer you wait. In the above example, if Toby invested a single dollar at 18 years old, that dollar would grow to be $54.76 dollars by the time they turned 59. If they waited a decade and invested that dollar at the age of 28, it would only grow to $21.11.

Investing in the stock market does come with financial risk, but that risk varies depending on what you invest in. ETFs, which follow the performance of the S&P 500, are relatively safe investments.

The S&P 500 index fund, which is the best gauge of the overall US stock market, has an average return of 10.13% a year. That’s through the highs and lows from 1957 through the end of 2022.

I’m by no means qualified to offer investing advice. (I just opened a retirement account this year.) My goal is to share some basic information to help you get started.

So do your own research into opening an IRA (individual retirement account.) Open one sooner rather than later to take advantage of compound growth. And if you don’t know where to start, consider a target-date fund. These funds are ETFs that mix different types of investments into one, diverse portfolio. Target-date funds adjust automatically to be more financially conservative as you get closer to your selected retirement year.

Final thoughts.

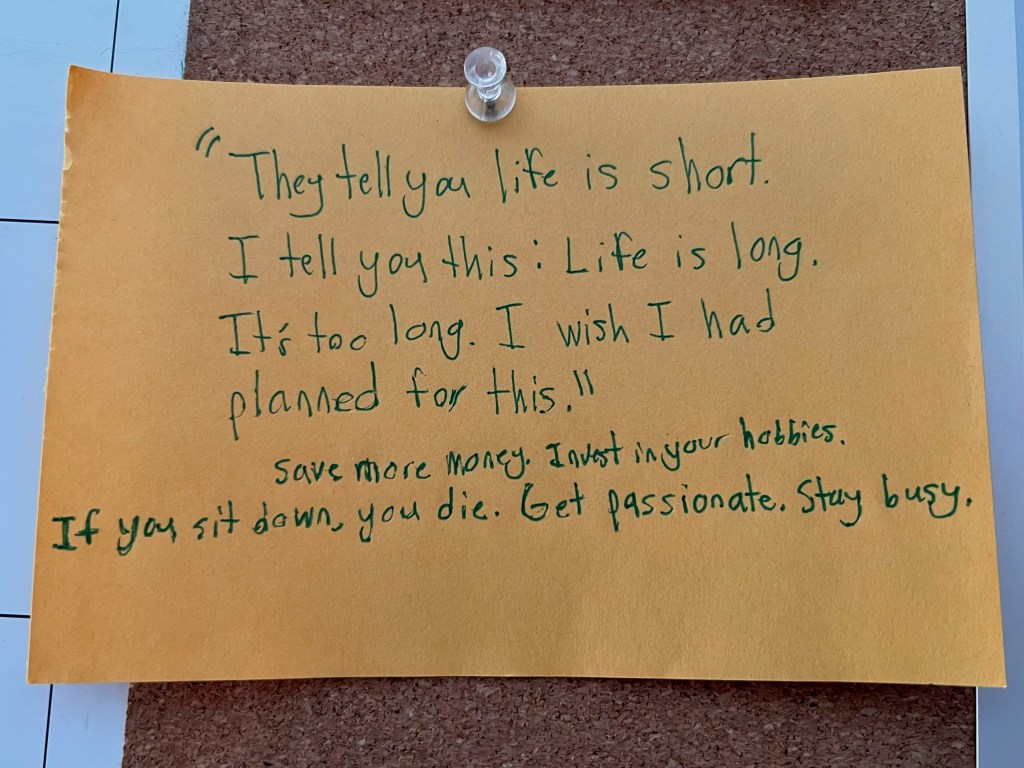

Scrolling through the comment section of a Caleb Hammer video, I came across a quote from an old lady.

“They tell you life is short. I tell you this: Life is long. It’s too long. I wish I had planned for this.”

The commenter encouraged others to save more money and invest in their hobbies. “If you sit down, you die. Get passionate. Stay busy.”

I have a note on my desk reminding me to do so. I look at it when I have the urge to doom-scroll the day away. Whether or not I succeed in my goals, I wanna be able to say that I gave it my best shot.

Leave a comment